The paradox of chasing retail while retail moves on

Across the airline industry, a transformation is underway. Carriers are investing billions to modernize legacy systems, embracing dynamic pricing, personalization engines, and the “Offer-Order-Settle-Deliver” framework that mirrors how Amazon and other e-commerce leaders operate. After decades tethered to rigid fare classes and distribution constraints, airlines are finally thinking like retailers.

But the strategic irony is that while airlines sprint toward modern retail capabilities, the retailers they’re emulating are already evolving beyond selling products. They’re becoming platform companies that control the underlying infrastructure—payments, logistics, data—that enables commerce itself.

Consider Amazon’s trajectory. For years, it relied on UPS, FedEx, and the U.S. Postal Service for delivery. But as volume grew and margins tightened, Amazon invested over $60 billion in building its own logistics network. By 2023, more than 75% of U.S. Amazon orders moved through internal fulfillment infrastructure, cutting last-mile costs while giving third-party sellers access to world-class logistics capabilities.

The pattern is clear: when intermediaries add cost, limit control, or obscure data, platform leaders build their own infrastructure.

Now that same playbook is emerging in payments. Both Amazon and Walmart are exploring proprietary digital payment systems—potentially including stablecoins or digital currencies—that could bypass Visa and Mastercard networks entirely. The goal is to reclaim billions in annual interchange fees while gaining complete control over transaction data and customer relationships.

For airlines in the U.S. watching from the sidelines, this shift carries profound implications. Because the economics of airline loyalty programs—and by extension, a significant portion of airline profitability—rest entirely on the interchange system these retailers are working to disrupt.

The hidden machine: How interchange fuels airline loyalty

Behind every frequent flyer mile earned on a co-branded credit card sits a complex financial mechanism most travelers never see: the interchange system.

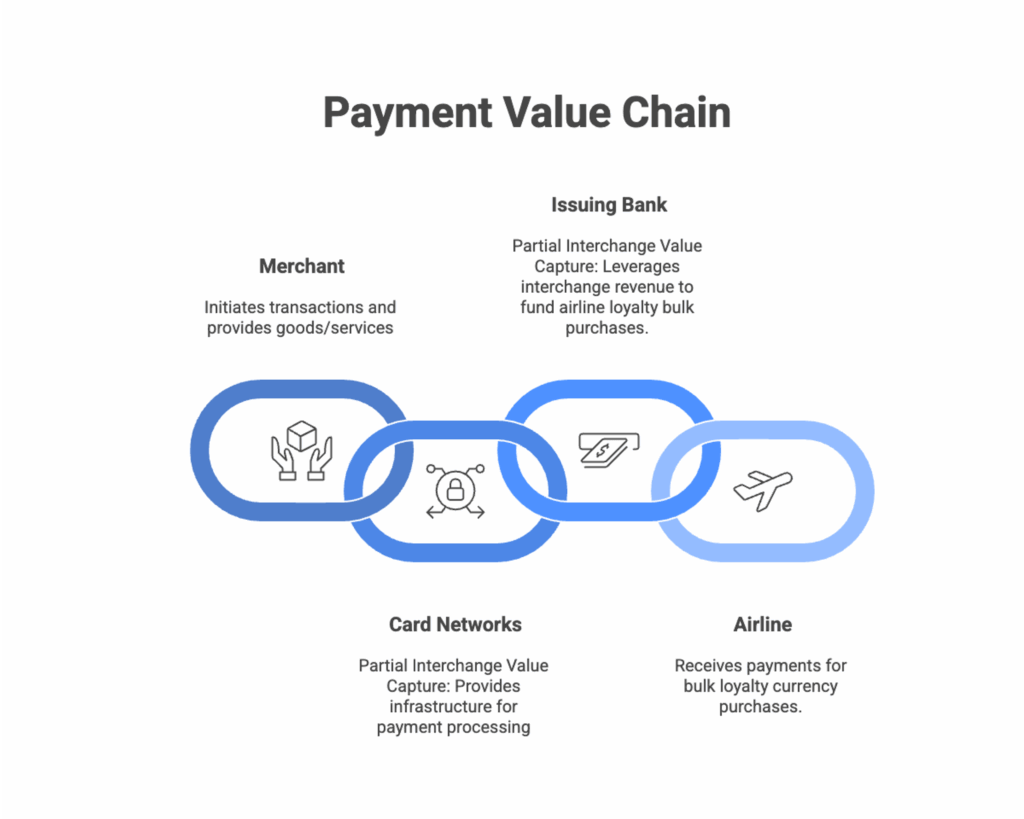

When a consumer swipes a credit card in the U.S., approximately 2% of the transaction value (the interchange fee) flows from the merchant to the bank that issued the card. This compensates the bank for fraud risk, credit extension, and transaction processing. Card networks like Visa and Mastercard set the rules and rates, taking a smaller cut (typically around 0.15-0.25%), while issuing banks capture the majority.

On a $100 purchase, roughly $1.75 goes to the issuing bank, $0.18 to the card network, with the remainder covering payment processing.

Figure 1: Current State Loyalty Ecosystem

This design emerged in the 1960s as early card networks needed to balance incentives between merchants and banks to drive adoption. As consumer credit exploded through the 1980s and 1990s, interchange evolved from a cost-sharing mechanism into one of the largest revenue streams in American finance. By 2023, U.S. merchants paid over $100 billion in credit card fees.

That massive pool underwrites much of the airline loyalty economy. Banks use portions of their interchange revenue to purchase billions of dollars’ worth of miles and points from airlines annually—providing immediate cash to airlines while rewarding cardholders for spending. These prepaid purchases supply steady cash flow that many carriers now depend on for liquidity and operations (and ultimately profitability), while managing the deferred liability of future award redemptions.

The model works elegantly: merchants fund interchange → banks collect and purchase loyalty currency → airlines receive cash and defer costs → cardholders earn rewards and maintain engagement with both their card and preferred airline.

Figure 2: Payment Value Chain — Merchant, Card Networks, Issuing Bank, Airline

The fragile foundation of airline loyalty

However, this elegant system conceals a structural weakness: airlines sit at the bottom of this value chain, furthest from the actual transactions that generate revenue. Their loyalty income depends entirely on banks’ willingness and capacity to keep purchasing points. If regulatory caps, retailer payment innovations, or digital currencies reduce interchange revenue, that upstream contraction flows directly to airlines.

In a system where merchants bear costs, banks control purchasing, and card networks set rules, airlines are essentially passive beneficiaries—and that makes them uniquely vulnerable to disruption.

Two critical insights emerge from this structure:

First, “airline loyalty” is something of a misnomer.

The majority of loyalty currency in travel today originates from credit card spending, not flight frequency or single-brand devotion. A customer who flies once a year but spends $50,000 annually on a co-branded card generates far more loyalty currency than a weekly business traveler paying cash. And once earned, the vast majority of points sit idle in accounts—partly due to complex redemption processes, partly by design.

Second, incentives are misaligned.

Airlines can—and regularly do—devalue their currencies through award chart changes or dynamic pricing adjustments. From the customer’s perspective, rewards depreciate from the moment they’re earned. From the airline’s perspective, the ideal scenario is receiving upfront cash from banks while minimizing future redemption costs. Points that expire or go unredeemed represent pure profit (close to 100% margins). This creates an opaque system that erodes trust and fails to deliver genuine value exchange.

Impending change: Multiple vectors of disruption

The current model faces pressure from several directions:

- Retailer-driven innovation: If major retailers successfully divert even 10-15% of payment volume to proprietary systems, the impact on interchange pools could be substantial. Banks facing compressed revenue would have less capital to prepurchase loyalty currency, directly impacting airline cash flow.

- Regulatory scrutiny: Periodic legislative efforts to cap interchange fees—most recently the Credit Card Competition Act—reflect ongoing merchant frustration with processing costs. While these efforts face strong opposition and uncertain prospects, they signal sustained pressure on the current fee structure.

- Consumer expectations: Digital-native consumers increasingly expect transparency, flexibility, and real-time value. Traditional loyalty programs, with their blackout dates, award charts, and opaque valuations, feel increasingly antiquated.

None of these pressures guarantees immediate disruption. The interchange system is deeply entrenched, supported by powerful financial institutions, and provides genuine value through credit extension and fraud protection. However, the trajectory is clear: the model that has sustained airline loyalty for decades is entering a period of structural uncertainty. Major retail players like Amazon and Walmart, which contribute a significant share of wallet to U.S. consumer spending, are innovating specifically around proprietary digital currencies to bypass interchange.

Figure 3: Airline Loyalty Program Enterprise Value(s)

Loyalty 2.0 and the shift from liability to platform

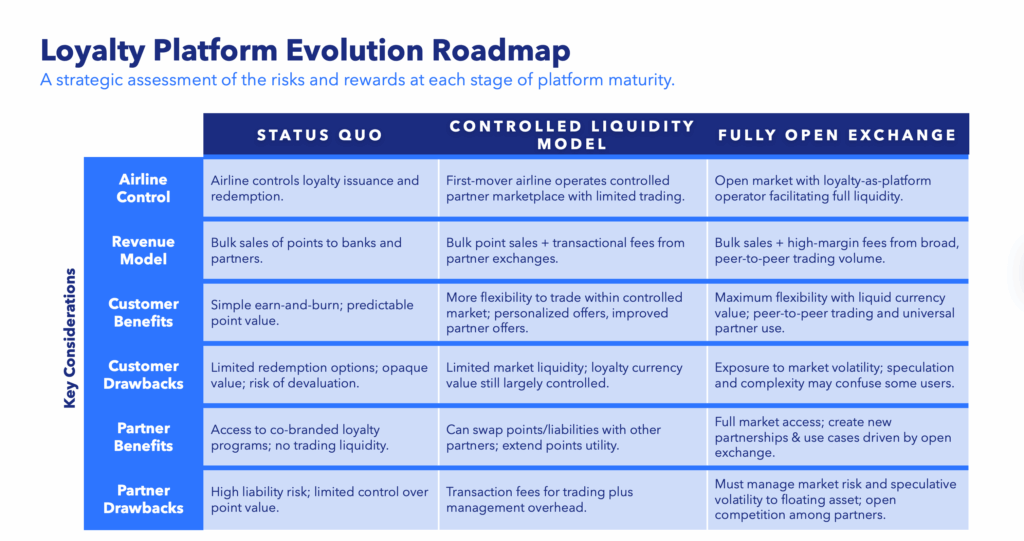

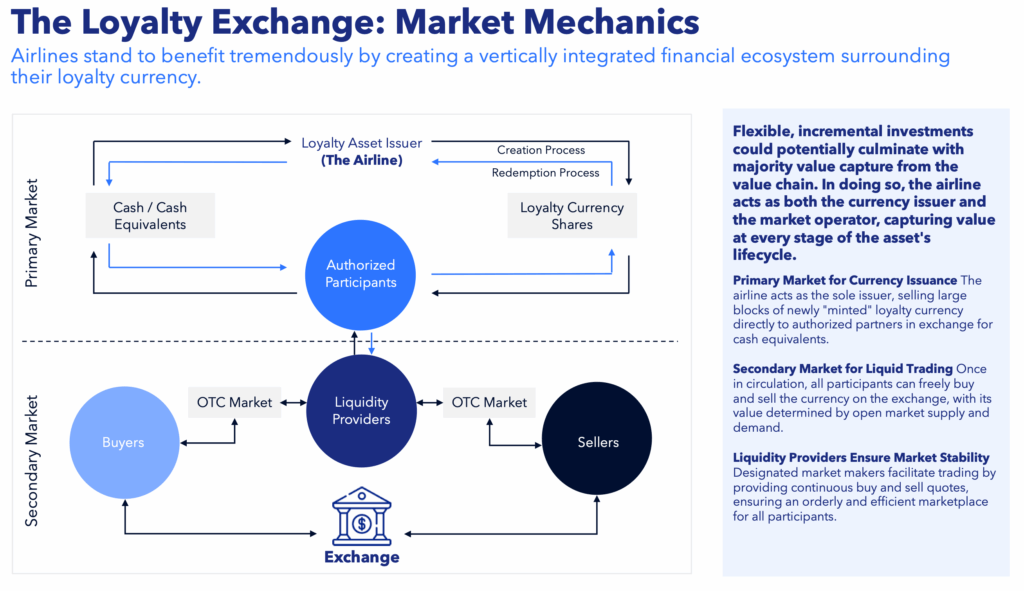

This disruption—uncomfortable as it may be—opens strategic possibilities. Rather than passively depending on third-party payment infrastructure, airlines could evolve loyalty programs into something more fundamental, such as platforms that create genuine value exchange among multiple participants.

The vision is to transform loyalty currency from an accounting liability into a flexible medium of exchange that serves customers, partners, and airlines more equitably. Along the way, monetize participation rather than fortress, single-brand loyalty. This requires several shifts.

- Increased transparency: Move beyond opaque point valuations toward clearer, more consistent redemption economics. Customers should understand what they’re earning and what it’s worth.

- Enhanced liquidity: Enable broader redemption options—not just flights and hotels, but experiences, retail purchases, and peer-to-peer transfers. The more ways points can create value, the more customers will engage.

- Dynamic management: Apply the same yield management sophistication airlines use for fares to award inventory, balancing accessibility with profitability in real-time.

- Partner monetization: Rather than viewing loyalty as purely a bank-funded program, create a multi-sided platform where partners pay for access to high-value customers and distribution.

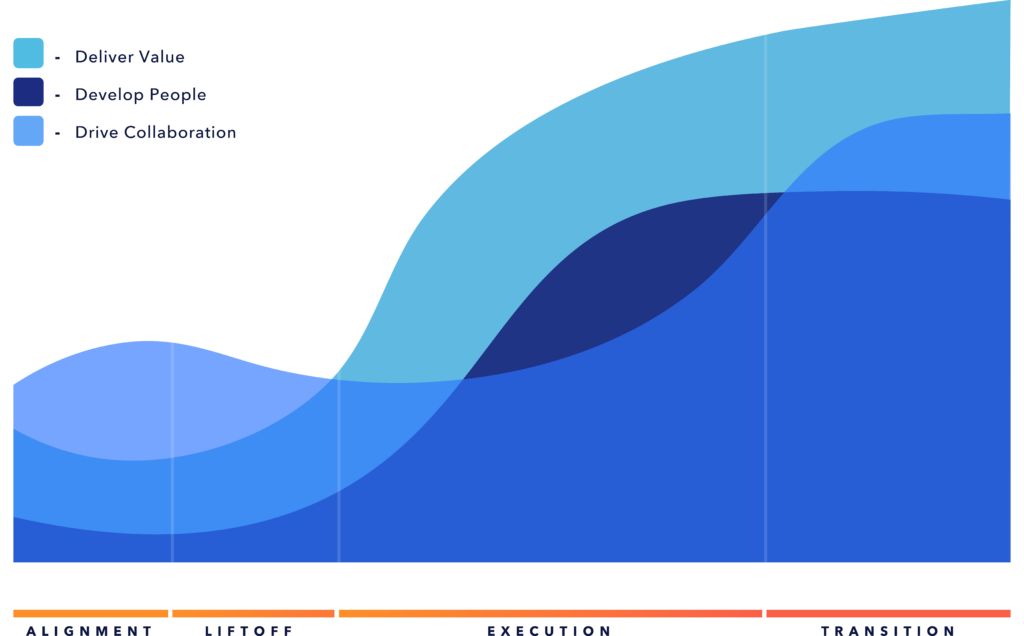

Figure 4: Loyalty Platform Evolution Roadmap

Early signals suggest this evolution is already underway. Virgin Atlantic recently expanded its entire unsold inventory for points redemption. AirAsia has implemented a points-to-cash liquidity model in partnership with regional banks. These experiments point toward more open, flexible systems.

Reinventing loyalty: Acknowledging the challenges ahead

Implementation challenges are real, but the barriers to entry have never been lower. Building payment infrastructure still requires regulatory compliance (money transmission licenses, AML/KYC programs) and technical capabilities beyond most airlines’ core competencies. However, the technology and regulatory landscape have evolved dramatically over the past decade, making what once seemed impossible increasingly feasible.

Blockchain technology and smart contracts have fundamentally democratized access to financial infrastructure. What previously required years of custom development and massive capital investment can now be built using composable protocols and existing frameworks. The regulatory environment has also matured considerably—the normalization of stablecoins and digital assets has created clearer pathways for companies operating at the intersection of traditional finance and digital currency.

Consider Figure Technologies, which built an entire blockchain-based lending platform and successfully IPO’d in early 2025—all in less than seven years. This demonstrates that building financial infrastructure on modern technology stacks is not only possible but can be done at speeds that would have been unthinkable a decade ago.

The “tokenized loyalty” concept—whether blockchain-based or proprietary digital wallets—does require navigating regulatory frameworks, achieving critical mass for network effects, and solving user experience challenges. But these are increasingly solved problems, with emerging best practices and reference architectures that significantly accelerate implementation.

Airlines may find success either building with fintech partners or leveraging platform-as-a-service providers that handle technical complexity and compliance. They may also consider funding wholly owned start-up subsidiaries that can operate with the distinct skills and culture required to launch a new concept from the ground up. The strategic imperative isn’t necessarily ownership of technical rails, but rather control of the value proposition and customer relationship—and that control is more attainable now than at any point in history.

Beyond airlines: Broader implications for travel & hospitality

While airlines face the most immediate pressure—given their heavy reliance on co-branded card revenue—other travel segments share similar dependencies. Hotel chains, cruise lines, and car rental companies all operate loyalty programs funded partly by credit card partnerships. The same dynamics will eventually reach them.

The winners in the next decade may not be those with the largest fleets or most destinations, but rather those who successfully architect platforms that create ongoing value exchange across a broader ecosystem—monetizing participation from partners while delivering genuine utility to customers.

The strategic choice

Amazon built its logistics network when legacy carriers constrained speed and margin. It’s now exploring proprietary payment systems for similar reasons. Airlines face an analogous choice between continuing to depend on third-party systems, where they’re the most vulnerable participant, or evolving toward greater control over how value is created and exchanged.

This doesn’t mean every airline needs to become a fintech company. But it does mean rethinking loyalty as more than a liability management exercise—viewing it instead as a platform that, properly architected, could unlock new revenue streams, deepen customer relationships, and create sustainable competitive advantages.

Figure 5: Loyalty Exchange Concept

The path forward requires balancing ambition with realism, innovation with execution capability, and transformation with profitability. But airlines willing to navigate that complexity have a substantial opportunity to move from passive participants in someone else’s value chain to architects of their own economic ecosystem.

The question isn’t whether disruption is coming—it’s whether airlines will shape it or be shaped by it.

Author’s note: This article reflects analysis of publicly available information and industry trends. Specific strategic decisions should be informed by detailed financial modeling, regulatory assessment, and competitive analysis appropriate to individual circumstances.

Sources

- https://ossisto.com/blog/travel-tech-companies/

- https://www.mypos.com/en-gb/blog/business-guide/digital-transformation-in-the-travel-industry-facts-and-stats

- https://zoftify.com/blog/digital-transformation-travel-industry

- https://stqry.com/blog/digital-transformation-in-travel-industry/

- https://amadeus.com/en/blog/articles/new-technology-accelerates-digital-transformation-in-the-travel

- https://www.lizard.global/blog/digital-transformation-in-the-tourism-industry

- https://www.software.travel/blog/tips/digital-travel-transformation-from-automation-to-ai/

- https://coaxsoft.com/blog/how-artificial-intelligence-is-changing-the-travel-industry-10-examples

- https://intellias.com/digital-transformation-in-the-travel-industry/

- https://jimmysjournal.substack.com/p/amazon-logistics-building-the-moat-of-the-future

- https://www.aboutamazon.com/news/transportation/amazon-investment-delivery-network-small-town-rural-us

- https://www.mwpvl.com/html/amazon_com.html

- https://www.freightwaves.com/news/amazon-logistics-historic-growth-spurt-in-context

- https://www.supplychaindive.com/news/amazon-ecommerce-warehouse-fulfillment-capital-investment/603731/

- https://www.businessinsider.com/amazon-timeline-history-fedex-ups-logistics-trucking-planes-vans-2019-12

- https://www.cbinsights.com/research/amazon-supply-chain/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC7419283/

- https://w3.accelya.com/airline-solutions-glossary/oosd/

- https://tpconnects.com/resources/revolutionizing-airline-retailing-the-power-of-offer-order-settlement-and-delivery/

- https://www.phocuswire.com/airlines-leverage-oosd-drive-revenue

- https://www.wsj.com/finance/banking/walmart-amazon-stablecoin-07de2fdd

- https://www.forbes.com/sites/ronshevlin/2025/06/22/americans-will-put-money-in-amazon-and-walmart-stablecoins/

- https://thewisemarketer.com/how-airlines-turn-miles-into-gold-lessons-from-the-business-of-loyalty/

- https://www.atlys.com/blog/frequent-flyer-programs-economics

- https://www.cnn.com/2024/09/08/business/frequent-flyer-programs-airlines

- https://onemileatatime.com/news/airlines-operate-loss-leaders-loyalty-programs/

- https://www.investopedia.com/why-airlines-like-high-credit-card-fees-11747639

- https://www.reuters.com/business/aerospace-defense/airlines-planemakers-oppose-credit-card-fee-crackdown-that-could-imperil-free-2025-06-02/

- https://laweconcenter.org/resources/the-credit-card-competition-acts-potential-effects-on-airline-co-branded-cards-airlines-and-consumers/

- https://flights.virginatlantic.com/en-us/points-flight-deals

- https://www.airasia.com/rewards/earn/en/gb

- https://www.virginatlantic.com/flying-club/spend-points/reward-seats

- https://conversioncapital.com/the-interchange-model-is-evolving/

- https://en.wikipedia.org/wiki/Interchange_fee

- https://www.lithic.com/blog/interchange

- https://merchantspaymentscoalition.com/visa-mastercard-credit-card-swipe-fees-hit-record-100-billion-first-time-2023-underscoring-need

- https://www.economist.com/business/2025/08/06/how-loyalty-programmes-are-keeping-americas-airlines-aloft

- https://www.nytimes.com/2025/09/06/business/frequent-flier-loyalty-programs-airlines-credit-cards.html

- https://crankyflier.com/2025/03/24/how-the-airline-credit-card-financial-model-works-very-well-thanks-for-asking/

- https://abnk.assembly.ca.gov/sites/abnk.assembly.ca.gov/files/hearings/01_25_10_The_Evolution_of_InterchangeFeesreport.pdf

- https://www.atlys.com/blog/frequent-flyer-programs-economics

- https://www.clearlypayments.com/interchange-rates-in-usa/

- https://thepointsguy.com/news/bank-purchases-points-and-miles-mean-future-of-loyalty-programs/

- https://www.federalreserve.gov/regreform/reform-interchange.htm

- https://stripe.com/resources/more/interchange-fees-101-what-they-are-how-they-work-and-how-to-cut-costs

- https://www.fxcintel.com/research/analysis/understanding-interchange-fees

- https://staxpayments.com/blog/understanding-interchange-fees/

- https://www.nerdwallet.com/article/travel/the-new-rules-of-airline-loyalty-programs

- https://gravitypayments.com/blog/visa-and-mastercard-unpacking-the-rates-changes/

- https://ideaworkscompany.com/wp-content/uploads/2024/04/Airline-Loyalty-and-Co-Branding.pdf

- https://norbr.com/library/paydecoding/interchange-fees-for-dummies/

- https://www.sciencedirect.com/science/article/pii/S2949899625000127