Check out the first article in this three-part series here. There’s no question of the immense value in scaling out affiliate and referral networks. However, we’ve established that software and SaaS companies today are overly focused on applying this strategy to Services Firms, which is largely ineffective and leaves significant upside on the table.

Unsurprisingly, when you launch a partnership, you’re immediately faced with a two-front battle of influence internally and externally. Looking at the external dynamics (i.e., B2B), perhaps the most significant challenge is to meaningfully address and communicate a core value proposition for the partnership that fits both the SaaS and Services firm. In plain English, that’s the “what’s in it for me and why work with you?” moment.

Examining complements and conflicts

I was first introduced to the Business Model Canvas as an Associate here at Pariveda. I took an internal course called Strategic Thinking, led by Susan Paul, one of our Managing Vice Presidents in Dallas. To this day, I continue to reference and adapt this framework, which is a particularly fitting tool to help examine partnerships.

One of the most straightforward ways to get to the root of potential value-add is to simply look at which elements of the business models have synergies, and which do not. For this exercise, I took a subset of the canvas and compared the two archetypal business models for a SaaS Company and a Services Firm.

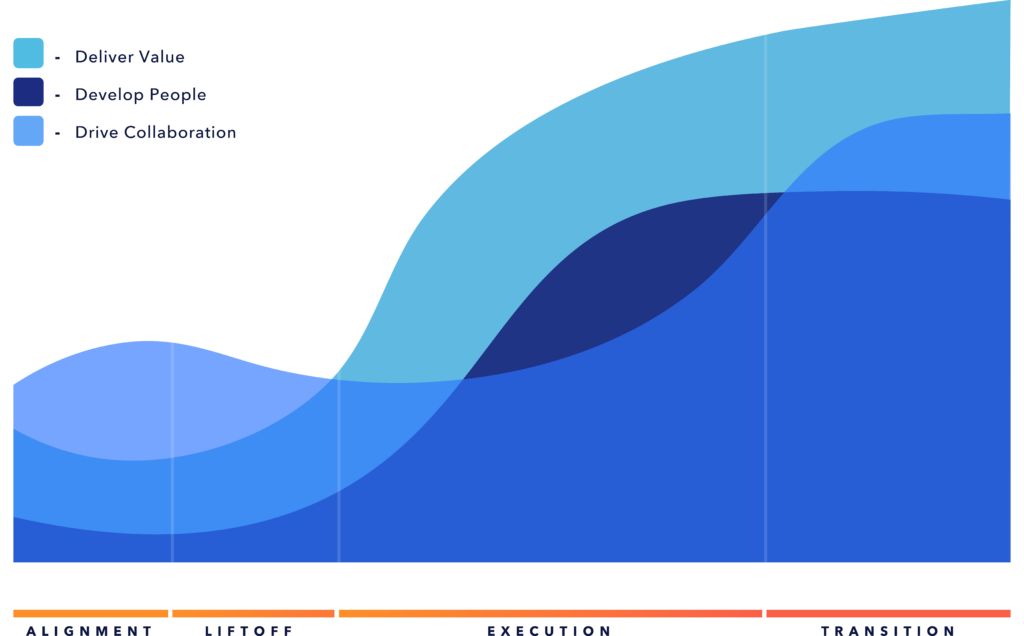

My observation is that the strongest complements exist between SaaS Companies and Services Firms within Value Proposition, Key Activities, and how Customer Relationships are approached.

Looking at Customer Relationship are handles, SaaS Companies are often good at building strong communities, robust documentation, and driving scalable self-service behaviors for their core Personas. Differently, Services Firms are typically good at nurturing long-term, trust directly with individual end-customers who reward them with repeat business. This is a great example of where complementary strengths can be leveraged through a partnership to meet the varied needs of customers depending on the circumstances.

Another great example of complementary strengths is in Key Activities. Successful SaaS companies will thrive if they nail product development (PLC) and network management, enabling them to continuously innovate and release new features to address broad customer needs. Services Firms are often good at digging into customer-specific problems. For example, determining what integrations or configurations should be used, how to restructure accountabilities, or map out what existing cross-functional processes might need to change.

On the other hand, revenue streams and cost structures are significantly different between the two organizations. These differences shape much of the core operations, and the mindset buyers take in rationalizing investment. For example, SaaS companies naturally reap exponential economies of scale. There is no such thing in the Services world, which is more linear. If not mitigated through the partnership model, the discrepancies here can be a major problem.

Overall, this is not an exhaustive comparison, but I want to illustrate that we need to look critically at the business models to align partnerships to value for the partners and, ultimately, the customer. A common pitfall I see in early conversations with potential partners is a tendency to dive right into account mapping. Tools that I use (like Crossbeam) make account mapping simple and secure. However, we won’t be able to build a foundation of trust without a clear value-add for mutual customers, an understanding of the complementary strengths, and a recognition of inherent conflicts. The partnership is too often doomed from the start, and client introductions will rarely happen.

Understanding the trust equation for services firms

Another incredibly important angle is the aspect of trust, which is at the core of advisory work such as Professional Services. A time-tested framework that I really like is the Trust Equation. This comes from the book The Trusted Advisor by Maister, Green, and Galford.

Effective partnerships with Services Firms must fill the need for credibility, reliability, intimacy, and self-orientation.

Trust questions

- How do I demonstrate that I am credible enough on this subject and solution?

- How do I ensure that the solution is reliable and does what I say it does?

- How can I give my customers a sense of safety and confidentiality?

- How do I prove that I am truly focused on the client and not my own selfish objectives or appearances?

Couple the trust questions with the questions regarding the value proposition for the partnership:

Core partner value proposition questions

- What is the market demand for the product and partnership?

- What potential services revenue exists for me?

- How much utilization will it cost to upskill a practice?

- What current skill sets or practices will I need to displace?

If aligning business models and establishing trust weren’t enough, creating a competing sales channel, partnerships also need to address internal tensions that arise within the software company itself. You’re essentially instigating a battle with the direct sales team by adding more stakeholders to coordinate (or compete) with. These conflicts threaten to complicate deals, flare up attribution battles, and jeopardize your sales team’s ability to hit on-target earnings. Not to mention, new attributes in CRM, extended processes and administrative overhead risk slowing Sales reps down and making them less productive.

Below is a handful of the most common concerns internally:

- What if I was already talking to that client?

- Why should partnerships be my job?

- What if the partner boxes me out, slows me down, or blows up my deal?

- Why should I trust a partner to know our product better than me?

- How do I even work with a partner?

Standing up a referral program for Services Firms generally fails to address any of these questions, conflicts, or complementary strengths.

Recognizing the cost of services gaps

So, this all seems like a whole lot of work, so why bother in the first place? If not to draw out referrals, why does strategically aligning with Services Firms even matter then? Because this Service Gap causes churn. According to Bain & Company, a customer is four times more likely to defect to a competitor if the problem is service-related than price- or product-related.

- Price isn’t the main reason for customer churn, it’s due to the overall poor quality of customer service. – Accenture Global CSR

- A customer is 4 times more likely to defect to a competitor if the problem is service-related than price- or product-related. – Bain & Company

- For every customer complaint, there are 26 other unhappy customers who have remained silent. – Lee Resource

Furthermore, Defaqto Research finds that 55% of customers would pay extra to guarantee better service. This means that by addressing the Service Gap we can reduce churn, drive topline revenue and unlock a scaling mechanism for the most un-scalable resource-intensive component of the SaaS business model: customer success and professional services.

- 55% of customers would pay extra to guarantee better service. – Defaqto research

- Americans will pay 17% more to do business with firms with great reputations when it comes to customer service. – American Express

- 67% of consumers and 74% of business buyers say they’ll pay more for a great experience. — Salesforce

Some immediate questions come to mind for how to quantify the cost of a Services Gap:

· How much churn could I eliminate through Services Partners?

· How can Services Partners help improve retention and scale adoption?

· How will Services Partners help me improve my NPS?

· How can I elevate pricing and positioning through Services Partners?

Focus on the whole product

The bigger picture is that a Services Gap is typically a symptom of incomplete focus on the Whole Product, a widely known concept described in Geoffrey A. Moore’s Crossing the Chasm. Moore shines a light on the holistic needs surrounding a generic product, such as training, support, standards, procedures, and integration. Failing to deliver a Whole Product often leads to disillusionment and eroded customer relationships.

Services Firms may be a viable solution to address these broader, non-core needs that your customers have. In the final article of this series, I’ll lay out my approach for how to take action, by assessing, designing, and managing partnerships through a product-led approach.

Reference