As discussed in the first post of this two-part series, oil and gas companies need to let go of outdated defensive strategies and go on the offensive to best weather the energy transition and address climate change.

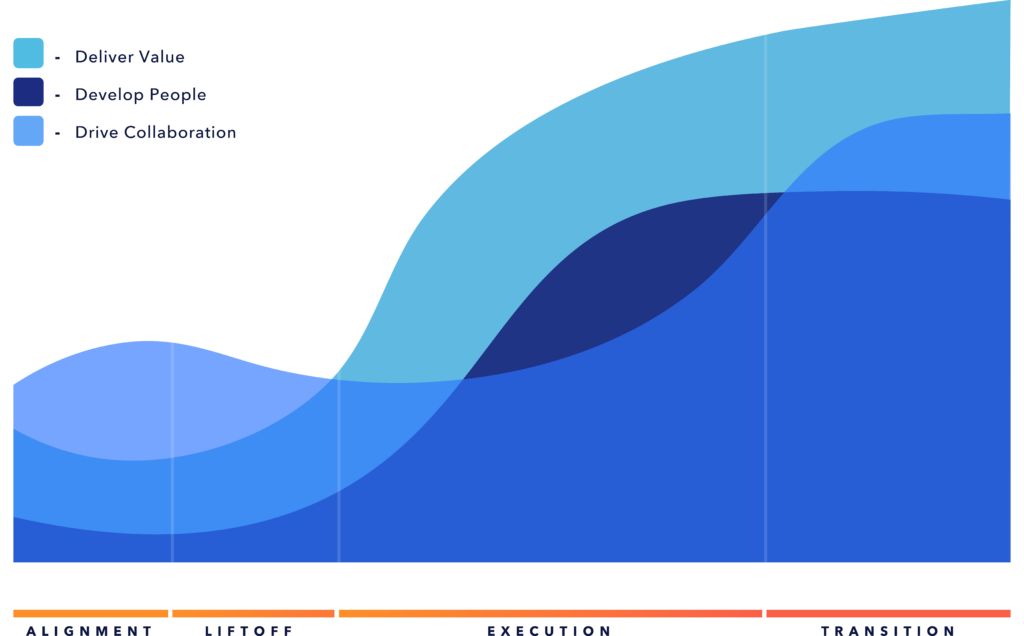

Oil and gas leaders should prioritize three basic steps now in order to achieve an effective transition to that new path and make good on the promise of the future.

Ditch the “lead, follow, or get out of the way” mentality

Those oil and gas companies at the forefront of the energy transition (for the oil and gas industry, anyway) are, to some degree, “leading.” But when you look at what they’ve actually done, it’s minuscule compared to their overall operations. And then you have companies that simply refuse to change their business models due to a steadfast belief that their competencies fall tightly within the exploration and production of hydrocarbons; any other ventures would simply be a disservice to their shareholders.

All oil and gas companies need to reshape this thinking to ensure success. There is an incredible opportunity that exists both in the energy transition and the climate transition.

This is a long-game play, and oil and gas companies can take the lead as they have the tools, capabilities, and competencies necessary to lead in ways that other industries simply cannot. Oil and gas companies have the ability to tackle the energy and climate transition challenges holistically rather than in bits and pieces like other industries. Embrace the “infinite game” concept and step in. Look to policy and regulation plays to help shape the markets necessary to make these moves profitable enough for meaningful pursuit. Risk cannibalizing one business through the expansion of the other.

Broaden your vision beyond being an energy company

As stated in the first step, oil and gas companies have the tools, capabilities, and competencies necessary to compete in the energy transition and the climate transition. Oil and gas companies have embarked on this “massive incremental” change. It’s not a stretch to say most oil and gas companies are now seeing themselves as energy companies — some because “oil and gas” are considered a dirty term, others because they identify with the energy their commodities produce and seek a transition that feels more incremental than transformational.

This is such a limited forward-looking vision. With companies like Siemens asking for wind energy to be more expensive, you can easily play out a future in which the claims of Lewis Strauss with nuclear that energy will be too cheap to meter and see an industry that is racing toward massive commoditization where the profits become a battle or, worse yet, highly regulated by the government.

So why make this your future? Sure, there’s an intermediate play here as profits in the energy transition can be had, but it’s not a viable long-term play. Oil and gas companies need to expand their future visions to include more than energy. Look at the climate transition. There are massive infrastructure projects on the horizon — projects that look and behave just like the massive capital projects oil and gas tackle today to bring their product to market. Reapply these skills and tackle a market that will be net-net larger than the combined power generation plus oil and gas market by 2050. Chevron CEO Mike Wirth recognized oil and gas’s need to look beyond renewables, given the economics.

I applaud their recognition that their role in the future of energy was something other than wind and solar because they recognized that economics don’t work. Instead, they’re focusing energies where they do think they can make a difference. However, they need to go further and look beyond energy.

Build for innovation and disruption

“Innovation” is a word thrown around as if it is this magic pixie dust that, once applied, somehow guarantees profits and successful outcomes. Rather than ride that bandwagon into the sunset, let’s look at it differently. Innovation cycles are accelerating, aided by a decently integrated global economy that allows new ideas and products to spread rapidly. And the movements creating massive exogenous forces on oil and gas are only growing. Pair these together, and you will see accelerated disruption.

Dependency on oil and gas will remain strong for decades to come, but that is not a “hall pass” for oil and gas companies to slow-play their role in the energy and climate transition.

Oil and gas companies need to embrace a culture of innovation whose reach extends beyond energy. They must be willing to call a spade a spade and invite talent into their houses to solve the biggest problem in our world today — providing energy to all without causing massive harm to the environment. If not, someone else will. It arguably takes a decade to build competency to the point of profit-generating capability. And oil and gas need to shift and build new competencies to compete in the energy and climate transition. That starts with broadening their same passion for innovation in exploring, extracting, producing, and refining oil and gas to new areas of growth and new business models altogether.

Yes, oil and gas companies are uniquely positioned to help manage the rate of change in both the energy transition and the climate transition. They have all the competencies necessary to help lead the charge on both axes — but only if they pivot from a defensive posture to an offensive one. They can create the carrot by shaping the policies and regulations necessary to create the markets required to make managing this change a profitable venture. Because let’s be clear: Change will follow profit. We must create the incentives to drive this change and then develop the competencies (many of which oil and gas companies already have) to carry out the change.

But there are dangers. If we transition too quickly, we could create harm and damage on the order of billions of lives. There are those that live in emerging and developing economies — for example, parts of Africa and Asia — that simply can’t afford the same rate of energy transition as developed economies yet. If we suddenly force the market in a new direction, we could destroy their economies and wreak havoc on their livelihoods.

The energy and climate transitions are primed for leadership because the rate of change must be controlled and deliberate. There is a Goldilocks scenario where we risk harm in moving too quickly or too slowly. Therefore, this change must be led, and led by the industry, as it is too big for governments alone. And oil and gas companies have the means to lead it. They have the competencies necessary to operate across the world, manage and execute major capital projects and supply chains, navigate geopolitics, partner with a wide variety of government entities, innovate across STEM verticals, and drive policy and regulatory change. The catalyst comes in shifting these skills away from hydrocarbons to addressing the energy and climate transitions using a profit-driven approach. This profit-driven approach starts with driving the creation and the augmentation of the markets to make this path as, if not more, profitable than hydrocarbons.

The bottom line? If oil and gas companies flip the script and instead drive the change themselves, then they can essentially fuel and fund the transformation they need to make over time while leading the way in addressing both the energy and climate transitions.

It’s as simple — and as complex — as that.